cook county back taxes

Make sure to view a photo of your home to. 660 to 740 effective 7-1-2022.

How To Find Tax Delinquent Properties In Your Area Rethority

For 2020 and 2021 taxes please visit the Cook County Treasurers website.

. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology. When she took office though Preckwinkle promised to remedy that. Easy-to-use event registration and membership management software.

Find stories updates and expert opinion. Salaries are budgeted based on the fiscal year which is the 12 month period that begins on December 1 and ends on November 30 of the succeeding year. 118 North Clark Street Third Floor Room 320 Chicago IL 60602.

Pre-court mediation and case management for residents and landlords dealing with evictions or delinquent property taxes. To begin they may enter their 14-digit Property Index Number PIN or property address. ASCII characters only characters found on a standard US keyboard.

Build better experiences streamline admin tasks and grow your community with our customizable toolset. Once you search by PIN you can pay your current bill online or learn additional ways to pay by clicking More Tax Bill Information on the next page. Annual indexing effective July 1.

City to not seek back taxes. 6 to 30 characters long. If you dont have this handy you can look it up online by visiting either the Cook County Assessors website or the Cook County Property Tax Portal and searching by address.

Change your name and mailing address. 2016 by county ordinance. Clark Street Room 230 Chicago IL 60602.

To see if your taxes have been sold forfeited or open for prior years currently defined as 2019 and earlier please enter your property index number PIN in the search box below. Due to the pandemic and an ongoing upgrade of the Countys technology systems though Preckwinkle said property tax bills will be going out about four months late in 2022. Cook County Community Vaccination ProgramCook County Government Cook County Health and Cook County Department of Public Health are pleased to offer COVID-19 vaccinations to those living or working in Cook County.

For example taxes for Tax Year 2019 are due in 2020. But not everyone is 100 honest all the time. Yarbrough Cook County Clerk 118 N.

Step 1 Locate Your PIN. A county-wide sales tax rate of 175 is applicable to localities in Cook County in addition to the 625 Illinois sales tax. Heres how Cook Countys maximum sales tax rate of 115 compares to other counties around the United.

Ex-Cook County assessor worker admits he helped cut taxes by 1M in exchange for home improvements Lavdim Memisovski who agreed to cooperate with prosecutors pleaded guilty to conduct between. Even if the sellers did purchase title insurance it may have missed previous clouds. Your PIN is the 14-digit number found on your property tax bill from the County Treasurer.

She said for the last decade the bills have always gone out on time. Pay Online for Free. Computerized county records are still fairly new.

Its goal is to provide an objective view of the legal landscape in Cook County as well as an active forum for both sides of the argument. Because of cracks in the system regarding leasehold taxes businesses have failed to pay almost 90 million due to Cook County according to a Sun-Times Watchdogs investigation. Fritz Kaegi Cook County Assessor.

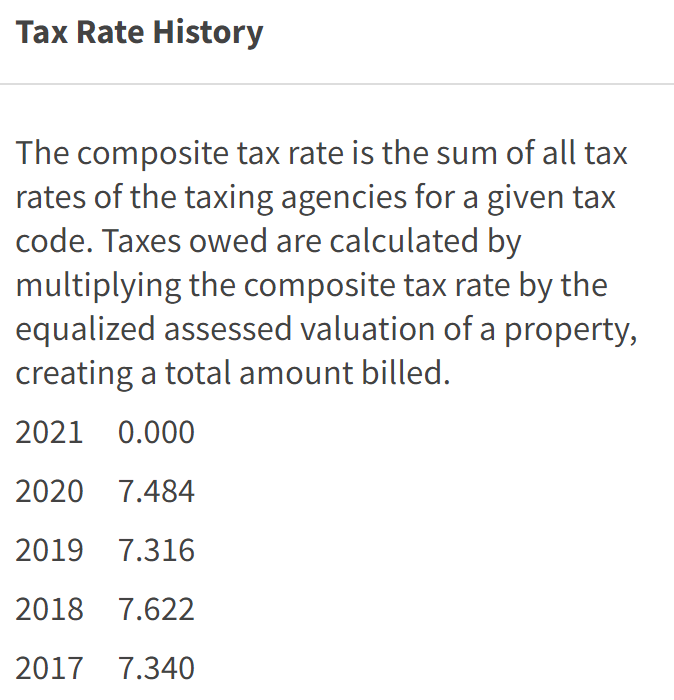

Search 34 million in missing exemptions going back four years. Cook County Record is a legal journal covering Cook Countys legal system. Billed Amounts Tax History.

Some cities and local governments in Cook County collect additional local sales taxes which can be as high as 35. Use your bank account to pay your property taxes with no fee. Cook Countys tipped minimum wage will be superseded by the state tipped minimum wage as of January 1 2023.

Apple had called the citys so-called Netflix. Providing services and security to county and court facilities administering the Cook County Jail and protecting and serving the citizens of Cook County with policing throughout the county. More than half owe less than 1000 in back taxes.

Local Township Assessors CCAO Office Locations Cook County Government Offices. Delinquent taxes for Tax Year 2017 and earlier are the jurisdiction of the Cook County Clerks Office. Cook county department of corrections 1 cook county department of public health 1 cook county elected officials 1 cook county facilities and services locator 3 cook county forest preserve boundaries 1 cook county jail 2 cook county map of elected officials 3.

This dataset contains information on estimated proposed salaries by position for all Cook County employees excluding the Forest Preserves of Cook County. Must contain at least 4 different symbols. Mission The Sheriff of Cook County is the Chief Law Enforcement Officer in the County.

Dog finds unique spot to keep an eye on her community. And her office had collected more than 750 million in early payments that Cook County taxpayers were able to deduct on their income taxes. Latest breaking news including politics crime and celebrity.

The seller is trying to sell the property so they may conveniently forget about those unpaid taxes. More Ways to Pay. This is commonly referred to as charging a back tax to a property omitted from the assessment roll.

The Cook County Treasurers Office provides payment status for current tax years and the ability to pay online. The minimum wage will not increase when Cook Countys unemployment rate is greater than 85 for the preceding year. Reduced staff from 250 employees in 1998 to 58 employees in Fiscal Year 2022 a reduction of 77 percent.

Cook County property owners are able to search for their records online. Cook County property taxes are collected one year after they are imposed. Trust but verify is the best course of action.

How UIC has cost Cook County taxpayers 12 million The university never told county officials it was leasing to a preschool which could be on the hook for over 800000 in property taxes. By Jonathan Bilyk Thursday Aug 11 2022 635pm. Search to see a 5-year history of the original tax amounts billed for a PIN.

That office generates the bulletins displayed on the tax bill in the area just above the payment coupon. Certified notice out on 45000 properties with unpaid taxes in Cook County. Under the provisions of the Illinois State Constitution the Sheriff has three primary responsibilities.

Billebookwormboogiewoogies Is Ready For Winter To Be Over Snow Cold Whereisspring Cold Snow Winter

Eric Muhr On Twitter Nursing Home Nurse Long Term Care

Cook County Land Bank Authority Rescued Josephine S Cooking In Chatham From Tax Sale Then Hosted An Event There Chicago Sun Times

Illinois Income And Property Tax Rebate Distribution Begins Next Month Here S How Much Relief You Could Be Eligible For Nbc Chicago

Illinois Income And Property Tax Rebate How To Know If You Re Eligible Nbc Chicago

Cook County Likely To Again Delay Property Tax Payment Deadline Crain S Chicago Business

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Property Tax Appeal Tips To Reduce Your Property Tax Bill

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Property Tax Portal

Homebuyer Seller Investor 2013 Tax Time Costs I Can Not Deduct Property Tax Tax Time Tax

How To Appeal Your Cook County Property Taxes The Details Income Tax Property Tax Tax Attorney

Cook County Property Tax Bills May Be Delayed By Inter Office Controversy Abc7 Chicago

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County Makes Millions By Selling Property Tax Debt But At What Cost Npr

Cook County 2nd Installment 2021 Tax Bills Delayed Lp

Amish School Shooting Amish School Shooting Amish Amish Culture

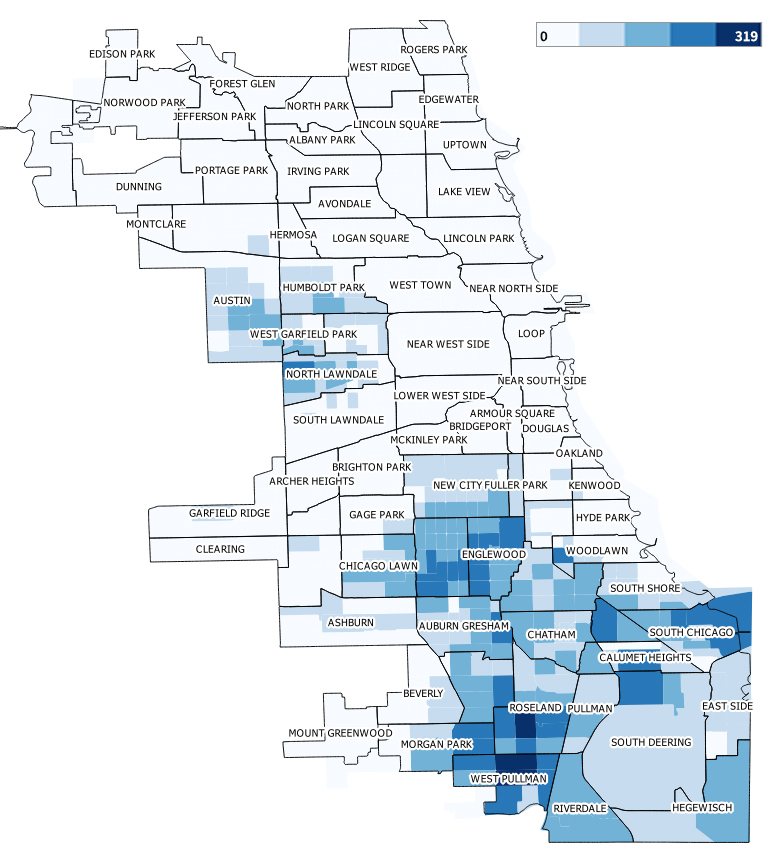

Racial Inequality Broken Property Tax System Blocks Black Wealth Building Bloomberg