homeowners insurance calculator wisconsin

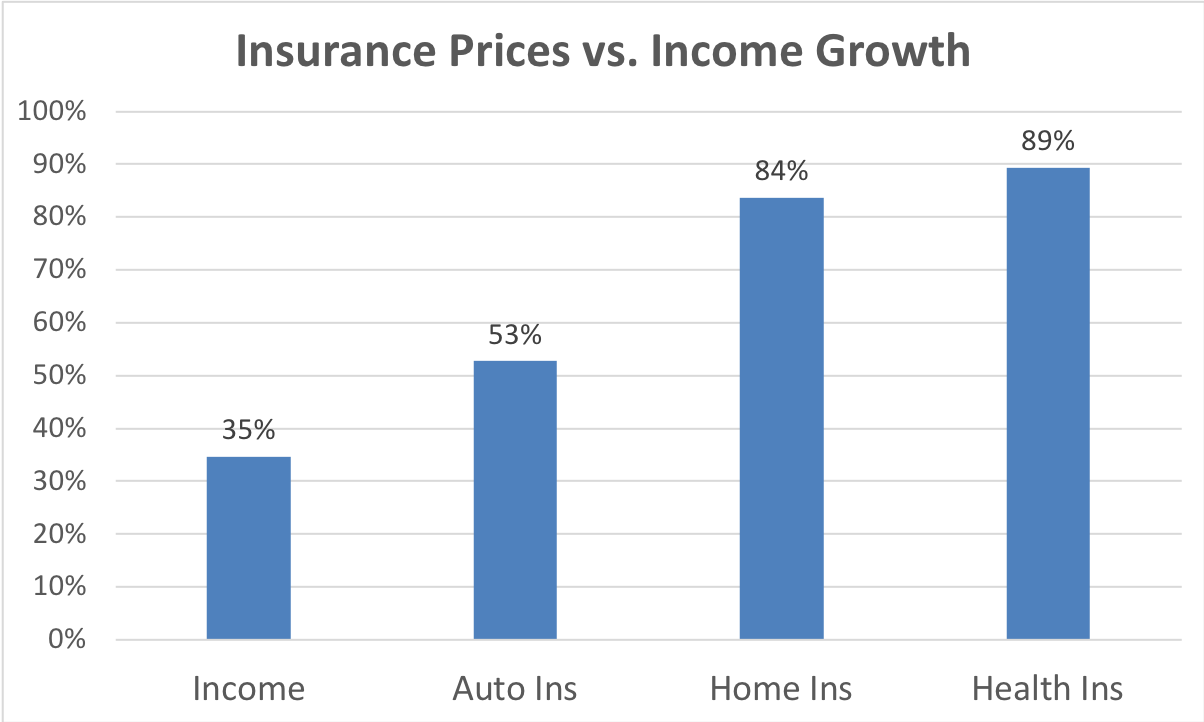

You can get a customized home insurance rate so you know what to. Around 10 of the states 72 counties pay an effective property tax rate over 2 with homeowners in Menominee County.

The Details The Good.

. Cities towns municipalities and school districts all levy separate taxes with their own rates. Dwelling personal property loss of use and personal liability. Calculate title insurance rates for your area and property value with our Title Insurance Rate Calculator from Old Republic Title.

The private flood insurance market uses an entirely different flood insurance cost calculator. The website features a live chat function that is quick and effective for curious customers in need of answers. The annual home insurance calculator will show you the average homeowners insurance cost for your neighborhood and desired policy limits.

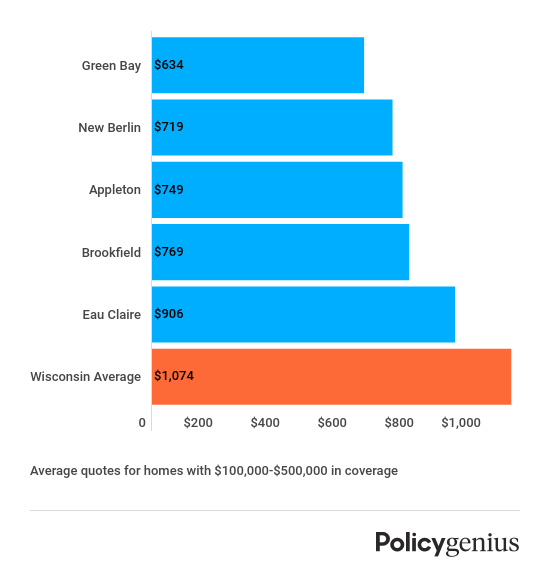

Homeowners insurance rates by ZIP code. The median amount of property taxes paid is around 3320 annually. Is 1249 per year or 104 a month according to the National Association of Insurance Commissioners NAIC.

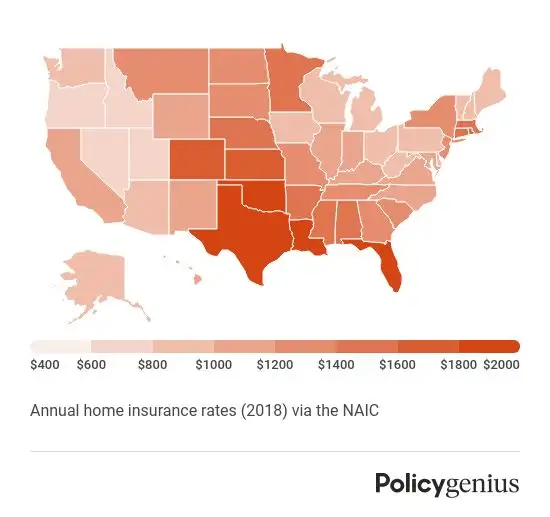

They combine high tech data analytics with advanced mapping using satellites and aircraft LADAR. The rates paid by homeowners in Wisconsin vary depending on where they live. What you pay for coverage depends on many factors but one of the major variables is where you live.

Further below we explain how to choose the best limits to ensure sufficient coverage and you will also get the home insurance estimates by zip code. Rates are calculated based on the total levy the revenue a tax district would like to generate divided by the total assessed value in the. Wisconsin homeowners pay some of the highest property taxes in the country.

NerdWallets mortgage calculators help you make decisions on your mortgage from finding the right neighborhood to choosing and managing a mortgage. A typical homeowners insurance package features four types of coverage. The average effective property tax rate in Wisconsin is 168 which is the eighth-highest in the US.

Use this free Florida Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. The least expensive policies are unsurprisingly the most restrictive. The private flood insurers rely on the most accurate digital land surveys available.

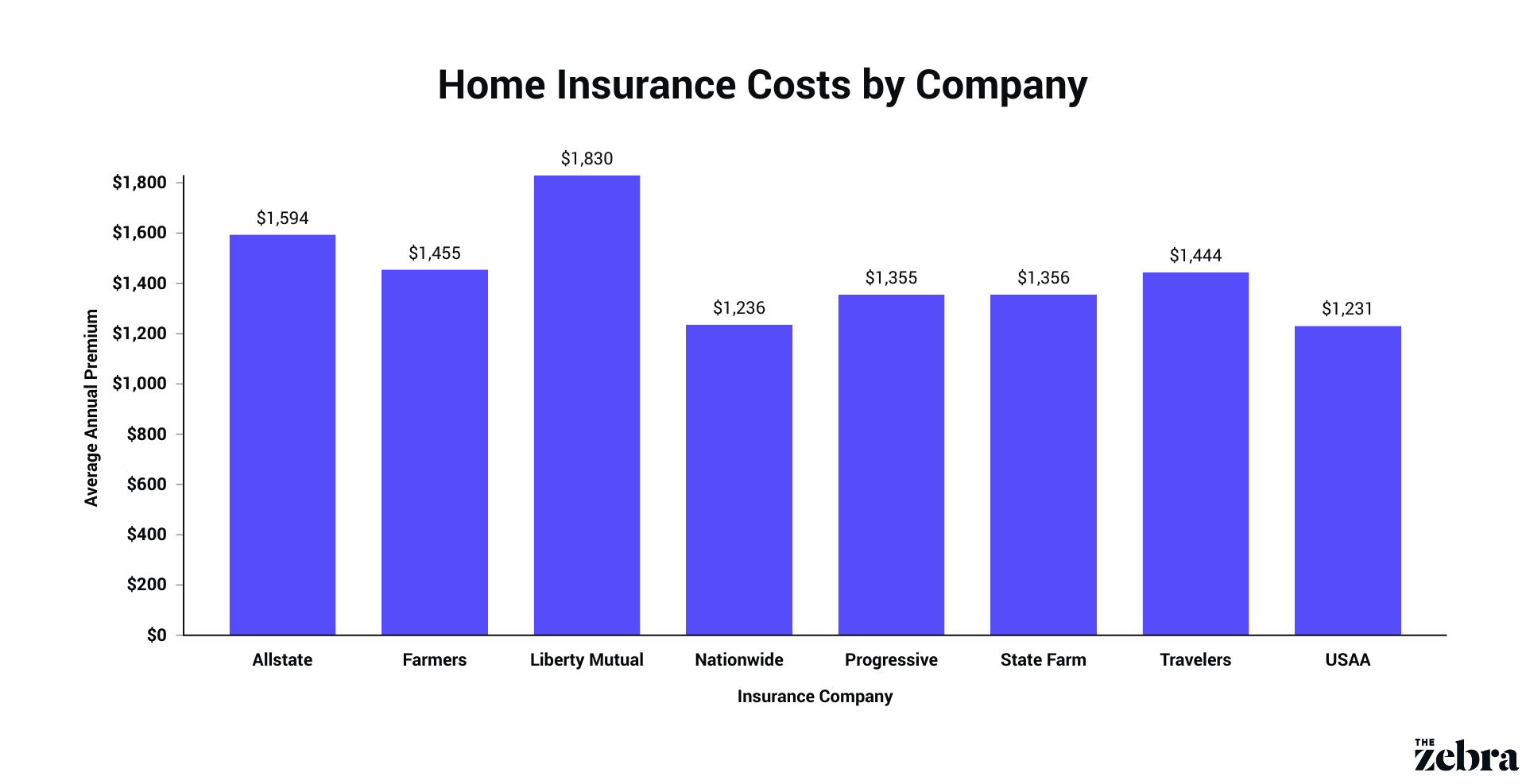

They also use heavy-hitting risk modeling to calculate every imaginable scenario to gauge the. While this is the basic structure of every homeowners insurance plan policies differ widely in what they cover. 1 But homeowners insurance rates vary widely based on where you live how old your home is how much itd cost to rebuild your house and your claims history.

Wisconsin Property Tax Rates. The average monthly premium 1125 is about 20 lower than those of most other homeowners insurance carriersLive chat available. By using our home insurance calculator below you can get a home insurance estimate for.

They will only reimburse. The average cost of homeowners insurance in the US.

Need Home Insurance Buy Home Insurance Policy To Cover Your Precious House Its Contents Get Ins Life Insurance Facts Life Insurance Quotes Insurance Quotes

The Best And Cheapest Homeowners Insurance In Wisconsin Valuepenguin

Infographic The Difference Between Home Insurance And Home Warranties Your Home Should Have Both Home Insurance Quotes Home Warranty Home Insurance

A Coverage Checklist For Home Insurance Contact Gcei For A Free Quote Farmers Insurance Homeowners Insurance Home Insurance

Home Insurance Calculator Home Insurance Premium Calculator Valchoice

Home Insurance Calculator Home Insurance Premium Calculator Valchoice